Texas Auto Insurance: Coverage, Requirements, and Cost Factors

Texas Auto Insurance is a critical component of responsible car ownership, providing financial protection in the event of accidents, theft, or other unexpected incidents. In Texas, like in many other states, having auto insurance is mandatory. Understanding the basics of Texas Auto Insurance can help drivers make informed decisions about coverage options, costs, and requirements.

Mandatory Coverage in Texas:

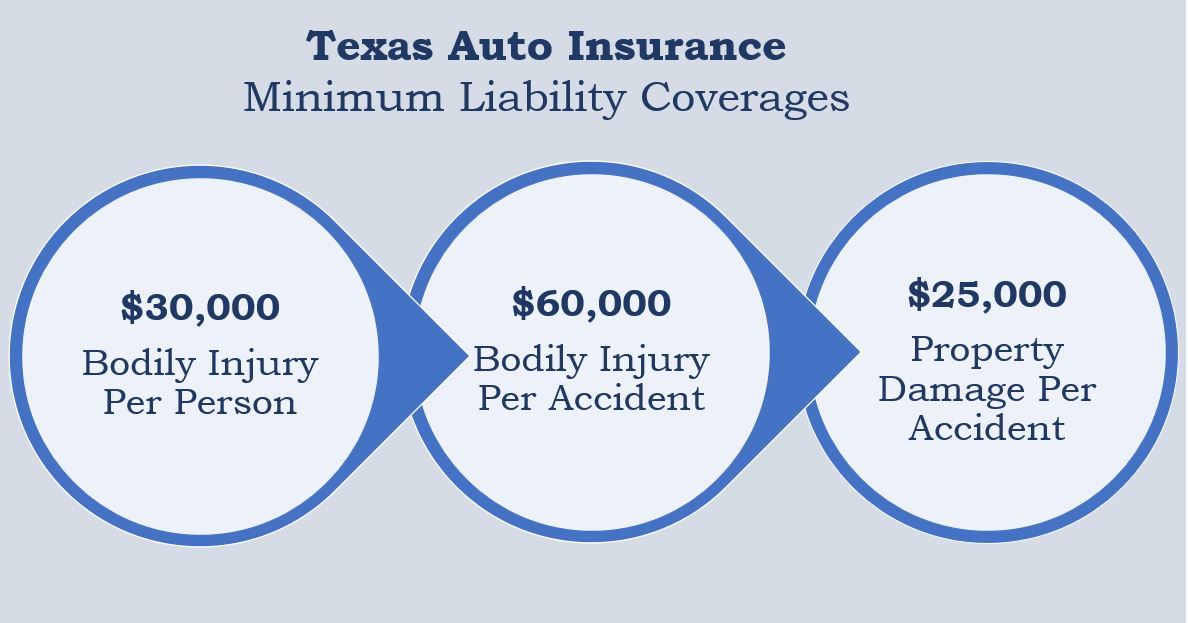

In Texas Auto Insurance, drivers are required to carry liability insurance to cover any damage or injuries they may cause to others in an accident. The minimum liability coverage limits are:

- $30,000 for each injured person

- $60,000 for injuries per incident

- $25,000 for property damage per incident

This is often referred to as “30/60/25” coverage. While these are the minimum requirements, drivers may choose to purchase higher limits for greater protection.

ये भी पढ़े: Will Refinancing Hurt My Credit: Understanding the Impact of Refinancing on Your Credit

Additional Coverage Options:

While liability insurance is mandatory, there are several additional coverage options available to Texas Auto Insurance drivers, including:

- Collision Coverage: This covers damage to your vehicle in the event of a collision with another vehicle or object, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This provides coverage if you are involved in an accident with a driver who does not have Texas Auto Insurance or does not have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of fault.

ये भी पढ़े: Lawyers Noble Profession of Law: A Comprehensive Insight into the World of Lawyers

Factors Affecting Auto Insurance Rates:

Several factors can influence the cost of auto insurance in Texas, including:

- Driving Record: Drivers with a history of accidents or traffic violations may pay higher premiums.

- Age and Gender: Younger drivers and male drivers typically pay higher rates.

- Vehicle Type: The make and model of your vehicle can affect insurance rates.

- Location: Urban areas often have higher rates due to increased traffic and crime rates.

- Credit Score: In Texas, insurance companies may use credit scores to determine rates.

ये भी पढ़े: Financial Services Sector: Navigating the Dynamic Landscape of the Financial Services Sector

Tips for Saving on Auto Insurance:

While Texas Auto Insurance is a necessary expense, there are ways to save money on your premiums, including:

- Bundle Policies: Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, for a discount.

- Drive Safely: Maintaining a clean driving record can help keep your rates low.

- Increase Deductibles: Choosing a higher deductible can lower your premium, but be sure you can afford the out-of-pocket expense if you need to file a claim.

- Shop Around: Compare quotes from multiple insurance companies to ensure you’re getting the best rate.

ये भी पढ़े: The Complete Guide to VA Loans for Multi-Family Properties

Conclusion:

Texas Auto Insurance is a vital part of owning and operating a vehicle in Texas. Understanding the coverage options, requirements, and cost factors can help drivers make informed decisions when purchasing insurance. By shopping around and exploring different options, drivers can find the right coverage at a competitive price Texas Auto Insurance.